Going Public

Communicating through IPO

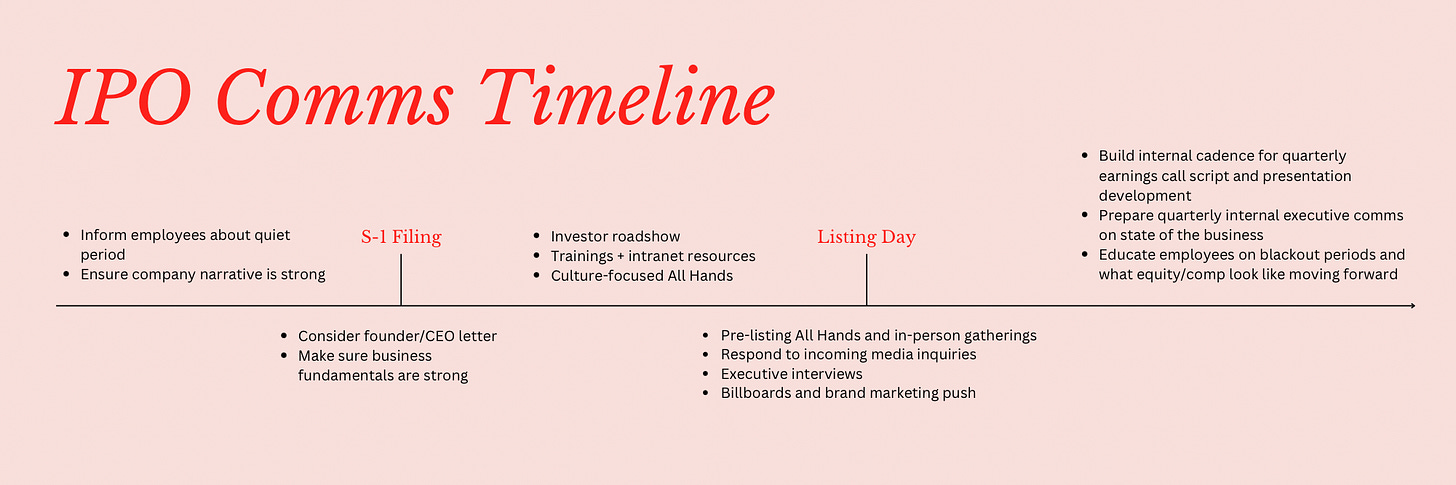

Last week’s successful Reddit IPO signaled the much-awaited return of the public listing. Having had the chance to be a part of Palantir’s 2020 direct listing as the company’s executive and internal comms lead, I wanted to share a few learnings for founders and comms teams considering going public in today’s thawing market.

This is largely a tactical guide, but before you jump into planning, here are a few high-level things to keep in mind:

Topline

Make sure you feel really good about your company’s narrative. This sounds obvious, but your company story needs to stand on its own by the time you submit your registration statement to the Securities and Exchange Commission, or SEC. If you’re executing a turnaround or need future growth to make your strategy plausible, consider waiting.

Employees are an essential audience. It’s easy to forget about your employee base when you’re focused on selling to institutional and retail investors, but the people who helped you build to this point are one of (if not THE) most essential audiences. They also have an enormous financial AND emotional stake in the company, so they’re 100x more sensitive to company news than other audiences.

Pick your spokespeople wisely. For founder-led companies, the external spokesperson is often the founder/CEO. But you also need someone to own communicating with employees, letting them know both what to expect tactically (how will IPO day go? When can they sell shares? How do taxes on equity work?) and culturally (will we become a totally different company now? What will change? What will stay the same?).

Pre-Quiet Period

Make sure you feel really confident in your company’s narrative before you file with the SEC. Once submit your registration statement, or S-1, you’ll enter what’s called a quiet period in which you can’t communicate anything beyond what’s in your prospectus (most companies choose not to do any external communication at all during this period).

You can’t say much about the business to employees during the quiet period, either, so make sure your employees are fired up before you file. Also make sure to set expectations with your employees before this process formally kicks off, including explicitly telling them that the quiet period means they should expect to see fewer external and internal comms during this period.

S-1 Filing

Any company filing to go public needs to file what’s called an S-1 with the Securities and Exchange Commission, or SEC. This document outlines your company’s business fundamentals and trajectory. Often this is the first time a private company will have publicly shared information like customer count or profitability, which makes the doc a juicy read for journalists. Since you can’t say much during the quiet period, make sure the data speaks for itself or you’ve already seeded potential rebuttals with reporters.

You can also add some more color to the S-1 in the form of letter from the founders or CEO. This is an increasingly common technique and one I recommend for framing up your company’s larger mission, as well as setting expectations with investors for what to expect moving forward. Google, for instance, made clear in its S-1 that it would continue to take the long view when making decisions about the company’s trajectory. Palantir told investors that they had “chosen sides” and that their software was used to target terrorists.

But be careful: even the most mission-driven letter from the founder can’t make up for weak business fundamentals. (Remember how WeWork wanted to “elevate the world’s consciousness” but was also burning insane amounts of cash with no clear case for becoming profitable?)

Employees can be especially squirrelly if the press reaction to the S-1 is negative, because it puts their entire livelihood at risk. If there are big surprises in the document, make sure you’ve already addressed them with your employees in other forums, like All Hands or Quarterly Business Reviews.

Also be mindful that all of your S-1 revisions will be on file with the SEC, so if you take some big swings that the SEC pulls back, that record will remain visible to journalists, employees, and investors.

Quiet Period

Once companies enter the quiet period, much of the leadership team will embark on what’s called an investor roadshow, where they pitch the company to institutional investors. I don’t know a ton about roadshows, so I’m going to focus here on communicating with employees, which should be one of your top priorities during this time. (No, seriously, pivot like 90% of your comms resources here.)

The absolute most important thing during this time is to convey to employees that (1) what they love about your company will not change (2) at the same time that some process-level things will change. I recommend landing this message with an All Hands just before or just after the S-1 is posted, depending on whether you’ve been transparent with the company that a listing is coming.

The best spokesperson for this is whoever has the most credibility with employees. Often this is a longtime employee and a right hand of the CEO (the COO or President, perhaps).

Then you need to get tactical with employees. They want to know things like, “What’s my tax bill going to be this year?” and, “Am I going to be rich?” Your investment bank may offer a training for employees; I recommend you not take the training wholesale but that you have your comms team partner with them to develop a series of webinars that explains how equity works (especially important if your company has issued multiple forms of equity to employees, like options and RSUs), how equity taxation works, and what people in different jurisdictions need to keep in mind.

At Palantir, we developed an intranet with overviews on these topics, as well as links to the webinar recordings. We also had a living FAQ that expanded as questions started to roll in.

IPO Day

There will be a TON going on the day-of. You’ll need to split up your PR, executive comms, brand marketing, and internal comms people to divide in conquer. A non-exhaustive list of things to think about:

PR: Someone needs to be on deck to man incoming questions about the listing. Prepare statements (or a “no comment”) in the event the listing performs above, under, or at expectations. And be ready to quickly draft a response for some kind of last-minute crisis, like a glitch that delays the actual listing by a few hours.

Executive comms: You can’t buy the kind of coverage you’re going to get today, so plan a few key media hits for your top spokespeople on outlets like CNBC and Cheddar. Prep the hell out of them, even if they’re distracted by everything else they need to do pre-list. Whether your IPO takes off or nosedives, you want your own people framing the story.

Brand marketing: The exchange you list on may offer you billboards or other marketing opportunities. Take advantage of them and supplement with your own digital buys—especially if you’re a consumer brand who can use the advertising to drive sales.

Internal comms: Take advantage of all of the external messaging for internal purposes. Get your people to gather by the billboards and take photos. Host mini-parties at your satellite offices or send sparkling cider if your company is all-remote. Distribute swag ahead of time. And day-of, considering hosting an All Hands or celebration for employees to keep them entertained until the stock actually lists, which may be hours after the market actually opens)

Moving Forward

Once you’ve listed, your journey has just begun. Now you’re subject to all the fun rules of being a public company, including blackout periods, quarterly earnings, and not disclosing material non-public information.

I won’t inundate you with the details here, but I will flag that you will need to start sharing internal, quarterly updates with your employees, either in writing or live. (Most companies do these as an internal-facing presentation shortly following earnings.)

Also consider kicking this new phase off with another All Hands or a rallying email from your internal spokesperson. Let employees revel in the upside of their hard work while also reminding them that this is only day one and the best is yet to come.

👋 Get in touch if you could use a consultant to help your company navigate its public listing.